Since the State Council rolled out the Master Plan for Hainan Free Trade Port (“HFTP” or “Hainan”) on June 1, 2020 (“Master Plan”), there have been significant policy developments from various departments and different levels of agencies in carrying out the Master Plan. On January 4, 2021, the National People’s Congress Standing Committee released the draft Hainan Free Trade Port Act for comment, signifying a critical step by China toward converting policy incentives for the HFTP into law.

This article summarizes current preferential policies available in the HFTP and attempts to provide foreign investors with a clearer picture of how China is building HFTP into a showcase of free trade.

1. HFTP Has the Shortest Version of the Negative List

Market access by foreign investors in China is regulated via a “negative list” approach. On June 23, 2020, NDRC and MOFCOM jointly issued the new Negative List for Foreign Investments (the “Nationwide Negative List”) and the new Negative List for Foreign Investments in the Pilot Free Trade Zones (the “FTZ Negative List”), both effective on the same day. The FTZ Negative List has 30 items as compared to the Nationwide Negative List, which contains 33 items.

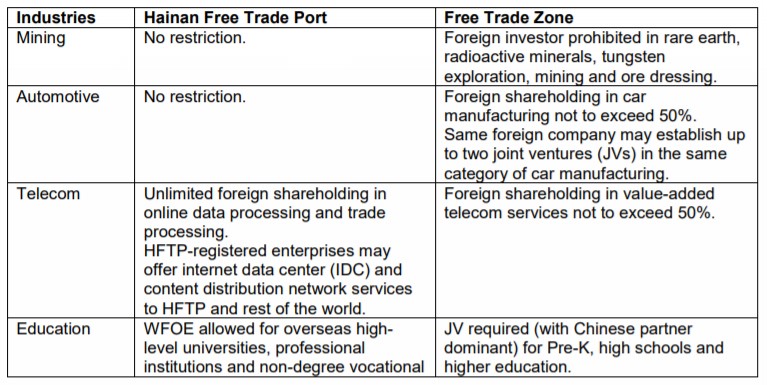

Notably, on December 31, 2020, the NDRC and MOFCOM published the Negative List for Foreign Investments in Hainan Free Trade Port (the “HFTP Negative List”), which consists of merely 27 items restricting foreign investments in relevant sectors. We summarize below the key differences between the HFTP Negative List and the FTZ Negative List:

Given this HFTP Negative List, foreign investors in the mining, automotive, telecom, education and social research services industries will be able to conduct and structure businesses that are otherwise not permitted anywhere else in China. Except for specific regulations related to the mining industry, foreign investors will generally be able to register and obtain their business licenses in Hainan in these industries and further expand in other locations in China.

2. Relaxed Rules of the QFLP regime in HFTP

The qualified foreign limited partnership (“QFLP”) regime grants foreign investors access to China’s domestic private equity market. Shanghai launched the first QFLP program in 2010. As of today, there are currently thirteen (13) pilot areas allowing QFLP, including the HFTP.

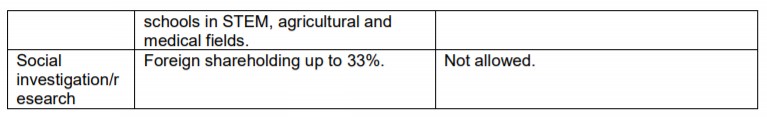

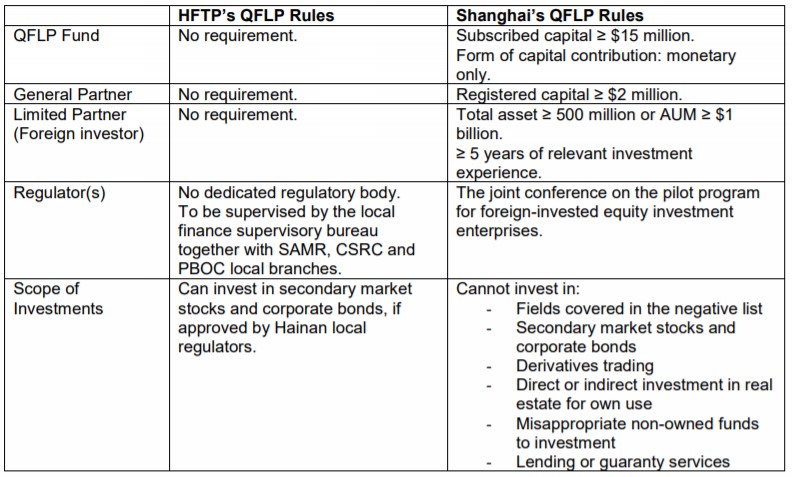

Notably, HFTP does not have the strict eligibility requirements that most other pilot areas’ QFLP rules have for the fund itself, the general partner or the limited partner. Taking Shanghai as an example, the chart below summarizes some key differences between HFTP and Shanghai’s QFLP rules:

As QFLP does not fall within the Nationwide Negative List, FTZ Negative List or the HFTP Negative List, foreign investors can have unlimited market access in setting up and operating QFLP funds throughout China. Given that eligibilities are not required in HFTP with respect to the fund itself and its partners, mid-to-small sized foreign fund managers may find Hainan to be an ideal place for them to set up their initial operation and participate in the growing Chinese domestic equity market.

3. Income Tax Incentives

a. Reduced Enterprise Income Tax (“EIT”)

Enterprises in China are generally subject to a 25% EIT of their taxable income. HFTP offers a reduced EIT of 15% if the following requirements are met: (i) its primary business activity is an encouraged business1; (ii) the revenue from such primary business activity accounts for 60% or more of the enterprise’s gross revenue; and (iii) it carries out substantial business operation in the HFTP. Importantly, to qualify for the “substantial business operation” test, the business shall have all four (4) elements in HFTP, which are: (i) business operation; (ii) personnel; (iii) books and records; and (iv) assets.2

b. Exempted EIT for Certain Outbound Direct Investments (“ODIs”)

In addition, for businesses in HFTP that are contemplating ODIs, HFTP is also offering exemptions from EIT if the following requirements are met:

c. Individual Income Tax (“IIT”)

Individuals may enjoy a reduced income tax rate capped at 15% if: (i) the individual is considered to have “high- end talents” or “talents in short supply” as deemed by the Hainan government; (ii) the individual earns eligible income derived from Hainan; and (iii) eligible incomes include wages, labor income, royalties, operational income and government subsidies for talents.4 This is quite attractive considering China’s highest individual income tax bracket is 45%.

4. Zero Tariffs Regime

The Master Plan calls for a list-based approach in regulating goods being exported and imported through Hainan. At the “first line” (i.e., from the rest of the world into HFTP), goods can generally be imported with zero tariff from overseas to HFTP, as long as they do not otherwise fall within the lists of goods prohibited from import or otherwise subject to specific tariffs.

Then at the “second line” (i.e., from HFTP into mainland China), tariffs are imposed if the goods are being imported to mainland China, with possible exemptions. Specifically, goods can be imported with zero tariff to Hainan, processed in Hainan and then sold to elsewhere in China at zero tariff, if: (i) they are for “encouraged business”; (ii) they meet a 30% value-added threshold; and (iii) the necessary “Hainan Origin Certificate” is obtained.5

Furthermore, businesses can be exempted from various taxes for certain equipment and materials imported for their own use. Specifically, an enterprise registered in HFTP may be exempted from import duties, import value- added tax and consumption tax if it imports certain production equipment for its own use. Such exemption is regulated by a short negative list.6

In addition, an enterprise registered in HFTP may be exempted from import duties, import value-added tax and consumption tax if it imports certain raw materials and auxiliary materials for its own production. Such exemption is regulated by a positive list.7

Hainan’s policy developments offer foreign investors who are interested in setting up operations in China an additional gateway, as compared with traditional options such as Shanghai, Beijing or Shenzhen. In particular, businesses in the mining, automotive, telecom, education and social research services industries that are generally limited in the rest of China will be able to set up their business in Hainan and expand it to the rest of China. Foreign fund managers who are of mid-to-small size may set up QFLP funds in Hainan with fewer requirements on capital and experience than in other cities.

For more information, please see the following resources:

• China Issues Measures for the Security Review of Foreign Investments, February 9, 2021

• China Patent Law Fourth Amendment—Impact on Foreign Companies, January 26, 2021

• China Regulators Remove Restrictions on Insurance Fund Investment, December 14, 2020

• China Releases Draft Personal Data Protection Law for Comments, November 12, 2020

• China Adopts Export Control Law, November 5, 2020

• China Releases New QFII/RQFII Rules, October 27, 2020

• China Releases Provisions on the Unreliable Entity List, October 5, 2020

• China Releases Draft Data Security Law, September 8, 2020

• China Releases Circular on Further Stabilizing Foreign Trade and Foreign Investment, August 24, 2020

• U.S. Listed Chinese Companies: Regulatory Scrutiny and Strategic Options, July 30, 2020

• China Passes Controversial Hong Kong National Security Law, July 9, 2020

• China's Relaxed Financial Sector May Aid Foreign Investors, June 18, 2020

• Is There a Law in China Similar to the US Defense Production Act?, May 8, 2020

• Coronavirus Brings Force Majeure Claims to LNG Contracts, March 4, 2020

• The Rise of China, March 4, 2020

• Coronavirus Fears Cast Cloud Over Dealmaking, February 27, 2020