In February 2023, the Financial Services Commission (“FSC”) published a ”Security Token Issuance and Distribution Regulation System Improvement Plan and Security Token Policy Tasks” (collectively referred to as the “Policy Tasks”). A security token is a security as defined under the Financial Investment Services and Capital Markets Act (the “FSCMA”) that is in a digitalized form and based on the distributed ledger technology. FSC replaced the term ”security-type token” with ”security token” to clarify that the FSCMA regulations on public disclosure, sales, and market order will apply. FSC unveiled its plan to overhaul the system that had previously caused difficulties in issuing and circulating security tokens.

The key policy tasks include (i) providing principles for determining whether a digital asset would be deemed to be a security (“Security Token Criteria”) and (ii) establishing a regulatory foundation to ensure an appropriate market for issuing and circulating security tokens. Security tokens issued overseas would may also be deemed to be a security under certain circumstances. An over-the-counter (“OTC”) market and a dedicated exchange at the Korea Exchange (“KRX”) will be introduced for trading security tokens. These measures are designed to mitigate regulatory uncertainties on security-type digital assets (including tokenization), to protect investors and to create a robust market for security tokens. By the way, non-security-type digital assets will be regulated by a separate statute, tentatively named the framework act on digital assets, etc., that is currently under deliberation at the National Assembly.

1. Security Token Criteria

The same criteria for “security” as defined under the FSCMA will apply in determining whether a digital asset is a security. In the Policy Tasks, FSC provided more detail on criteria for determining whether a given asset should be categorized as an investment contract security, which is a type of security under the FSCMA. As a general rule, whether a digital asset is categorized as a security will be determined on a case-by-case basis with emphasis on substance over form.

FSCMA defines security as ”financial investment instrument issued by a Korean national or a foreigner, for which an investor does not owe any obligation to make any payment other than the consideration that the investor paid at the time he acquires such instrument” (Article 4(1) of the FSCMA) and further categorize it into seven types: (1) debt securities, (2) equity securities, (3) beneficiary certificates, (4) investment contract securities, (5) derivative-linked securities, and (6) depositary receipts, and additionally (7) collective investment securities for collective investment schemes and investment trusts.

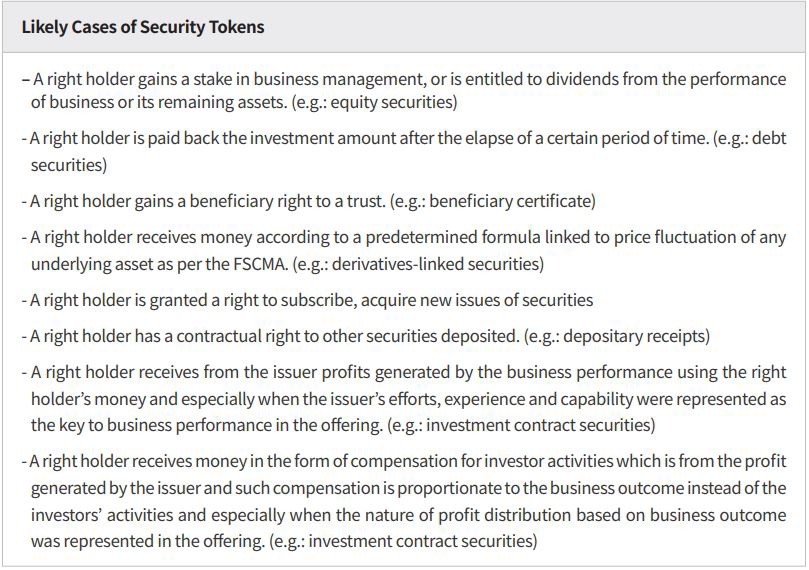

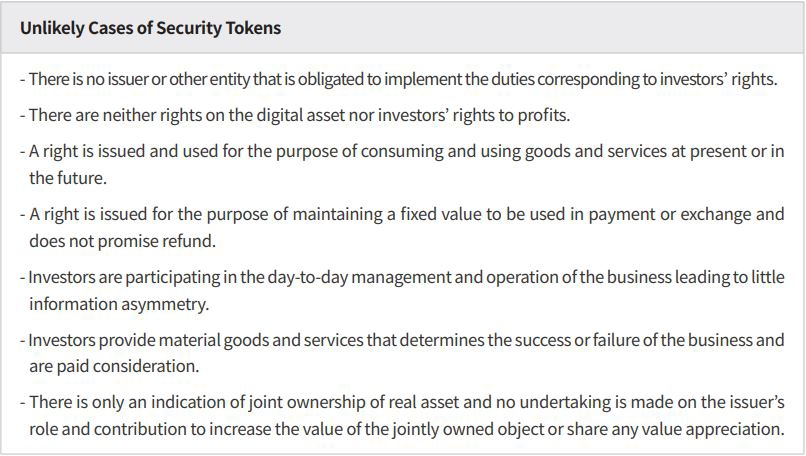

FSC provided the following examples for reference on applying the Security Token Criteria. These examples are expected to be supplemented over time by court rulings and FSC’s practice.

< Examples of Security Tokens >

The investment contract securities are the most pertinent type of security relating to security-type digital assets. Under the FSCMA, investment contract security is defined as “an instrument bearing the indication of a contractual right under which an investor invests money in a joint endeavor with another party and share any profit/loss from such endeavor mainly carried out by such other party (Article 4(6) of the FSCMA). This is quite conceptual and is thought to supplement the other more specifically defined ones. Nevertheless, this type of security has been recognized in limited circumstances, mainly in the context where the special rules on online small-sum retail brokerage or the rules on disclosure and unfair trading activity is applicable.

In the Policy Tasks, FSC set forth detailed requirements of investment contract securities as follows: