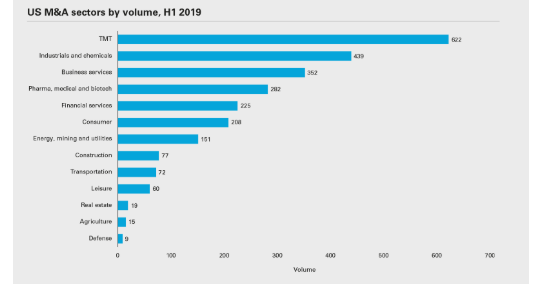

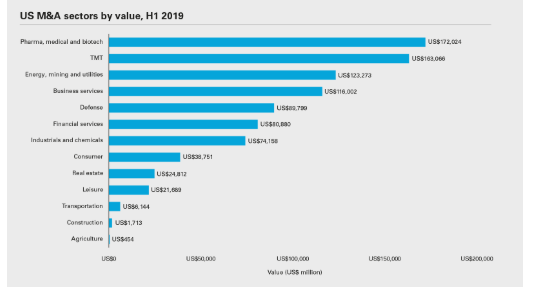

HEADLINES

- TMT led the pack in terms of volume in the first half of 2019, with 622 deals, followed by industrials and chemicals, with 439

- By value, PMB led the field, though a single megadeal accounted for more than half of the US$172 billion in total deal value

- Energy came in third in terms of value, even as deal volume fell sharply

The technology, media and telecoms (TMT) industry saw significantly more deals than any other during the first half of the year, racking up 42 percent more transactions than the next busiest sector: industrials and chemicals. These sectors were out in front by some distance, recording 622 and 439 M&A deals respectively during the first half, along with business services (352).

On the value front, the pharmaceutical, medical and biotech (PMB) industry led the way, with 282 transactions totaling just over US$172 billion—though more than half of this total stems from a single deal, Bristol-Myers Squibb’s US$89.5 billion purchase of Celgene.

The TMT sector recorded the second-biggest total deal value during the first half of the year, with US$163 billion of transactions. Energy, mining and utilities ranked third, despite having only seen 151 deals, collectively worth just over US$123 billion.

Business services was the only other sector to post a total deal value of more than US$100 billion during the first half of the year, with transactions collectively worth a little over US$116 billion.

By contrast, the industrials and chemicals sector only posted transactions worth US$74 billion, despite seeing more deals than any industry other than TMT. Financial services (US$80.8 billion from 225 transactions) and consumer (US$38.8 billion from 208 transactions) also posted significant total deal values, with real estate (US$24.8 billion from 19 transactions) further back.