You can find our most recent regular legal update here. We have also published newsletters on other significant recent developments, which are available at these links:

• Korean Labor Law: Expected Changes in 2026, available at this link.• Korea’s New Pro-Union Yellow Envelope Act Passes, available at this link.

1. Introduction of Short-Term Childcare Leave(Gender Equal Employment and Work-Family Balance Act, Article 19;not yet promulgated - effective 6 months after promulgation)

To address short-term childcare gaps—such as school/daycare closures,vacations, or child illness—employees will be able to use one or two weeksof short-term childcare leave once per year.

Childcare leave is currently limited to a total of one year per eligible child,or up to 1.5 years in specific cases, and the amount can generally only besplit into four separate use periods, making it difficult to use for short-termneeds. This amendment allows for more flexibility to handle brief childcare demands. However, any duration used for short-term childcare leave will still be deducted from the employee's total available childcare-leave amount.

2. Improvements to Risk Assessment System(Occupational Safety and Health Act, Article 36, etc.; effective June 1,2026)

Under Article 36 of the Occupational Safety and Health Act, all workplaces— regardless of industry or number of employees—must conduct health-and-safety risk assessments. This is a process where labor and management jointly identify hazards and risks, then establish and implement measures if those risks exceed permissible levels.

Starting June 1, 2026, the participation of employee representatives in the risk assessment process will be mandatory, and the results and key findings must be shared with all employees. Failure to conduct a risk assessment, lack of worker participation, failure to guarantee the participation of employee representatives, failure to share key findings, or failure to record and preserve results will result in an administrative fine of upto KRW 10 million.

Note: The fines will become effective in phases based on the number of employees (January 1, 2027 and January 1, 2028), with specific application criteria to be finalized at a later date.3. Introduction of Safety and Health Public Disclosure System

(Occupational Safety and Health Act, Article 10-2; effective August 1, 2026)Companies meeting certain criteria based on industry type and number of employees will be required to publicly disclose annually key information regarding occupational safety and health.

The contents for disclosure include:

• Safety and health management systems• Status of industrial accidents• Safety and health activity results from the previous year• Safety and health activity plans for the current year• Investments in safety and health• Measures and implementation plans for industrial accident prevention

Cases1.Korean Supreme Court decides performance-bonus cases, clarifying whichperformance bonuses are “wages.”Sup. Ct. 2021Da248299 (Jan. 29, 2026)Sup. Ct. 2022Da255454 (Jan. 29, 2026)

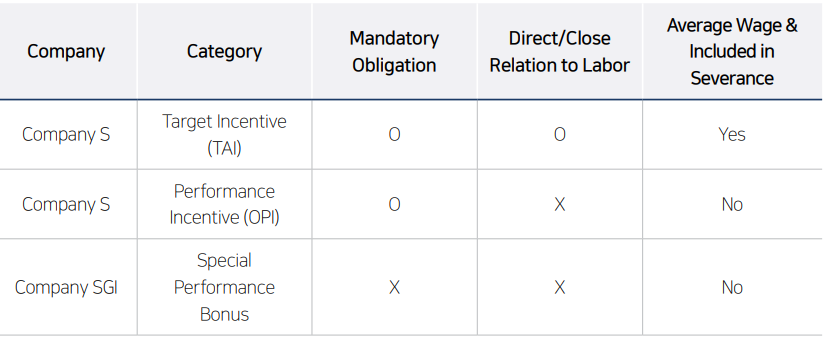

On January 29, 2026, the Supreme Court ruled that among the management performance bonuses (incentives) paid by an affiliate of a major Korean conglomerate (“Company S”), the Target Achievement Incentive (TAI) constitutes “wages” under the Labor Standards Act, whereas the Overall Performance Incentive (OPI) does not. This ruling overturned the lower court’s decision, which had held that none of Company S’s management performance bonuses constituted wages.If compensation is classified as “wages” under the Labor Standards Act, it must be included in employees’ average wage—the basis for calculating their severance pay or retirement pension benefits.

The Reasoning• Performance Incentive (OPI): This is a system where a certain percentage of the Economic Value Added (EVA) of each business division is distributed. The Court determined that the occurrence and scale of EVA were not closely related to the provision of labor, as they were influenced more heavily by external factors beyond the employees’ control. Thus, it was deemed an "ex post facto distribution of management outcomes." Even if the defendant (Company S) had an obligation to pay based on employment rules, it was found not to be wages.• Target Incentive (TAI): This is paid based on evaluations. The Court noted that not only were the payment conditions and standards set by the employment rules, but the scale of payment was somewhat fixed in advance. Employees could also directly influence or control the achievement of relevant targets through their work. Consequently, the Court found a high causal relationship with the provision of labor and a direct/close link between the labor provided and the company’s obligation to pay. In short, the TAI was held to be an “ex post facto settlement for labor performance” rather than a distribution from management outcomes. The TAI was thus found to be wages.

On the same day, the Supreme Court overturned a lower court’s ruling in a case involving “Special Performance Bonuses” at another company (“Company SGI”). In that case, the company and the labor union set payment standards through annual labor-management agreements, and the bonuses had been paid for a long time based on whether those standards were met. The Supreme Court ruled these were not wages, stating that the company did not have a mandatory obligation to pay them every year based on labormanagement practices. Instead, these payments were characterized as distributing profits based on thespecific management outcome of “realizing net profit,” where factors other than the employees' labor had significant influence.

Summary of Legal PrinciplesThe Supreme Court maintained its existing legal doctrine that for a payment to be “wages” under the Labor Standards Act:1. A payment obligation must be recognized via collective or individual agreement, employment rules, or labor practices.2. Such an obligation must be directly or closely related to the provision of labor.

Note: These were panel decisions, not En Banc (full bench) decisions. Other Supreme Court rulings on similar issues are scheduled for later this month, which may provide more specific criteria for determiningwhether incentives count toward average wages. We expect to share more news on this topic in the near future.

2.Korean Supreme Court holds that manager’s recording is not tortious.Sup. Ct. 2025Da204730 (Oct. 16, 2025)

BackgroundKorea’s Protection of Communications Secrets Act only prohibits and criminally punishes the recording of “conversations between others” (eavesdropping). However, even a person who is a party to the conversation can potentially be held liable for civil tort damages for violating a person’s “personality” rights, specifically their “voice rights” (privacy of one’s voice).The plaintiff in this case was a contract worker at a financial investment firm, and the defendant was a department head at the same company. Near the end of the plaintiff’s contract, the defendant notified the plaintiff that the branch where they worked was closing and that their contract would not be renewed. The defendant recorded all conversations with the plaintiff without consent. The plaintiff filed a lawsuit for damages, claiming that the recording violated their personality rights and constituted a tort.

RulingThe first and second instance courts rejected the claim of personality-rights infringement based on several factors:1. The recording did not concern the plaintiff’s private life; it concerned the employment contract betweenthe plaintiff and the company.2. The recording took place at a business office, which has a lower expectation of privacy.3. The defendant did not manipulate the conversation for a specific purpose or extract only favorable parts.4. The recordings were used only as evidence for the Labor Relations Commission or the court.

The Supreme Court upheld the lower court's decision, dismissing the plaintiff's appeal and holding that the recording fell within the scope of what the plaintiff should reasonably tolerate and was not illegal.

Legal SignificanceThis ruling is significant because it provides criteria to consider when determining if such a recording constitutes a tort:• Whether the recording was made through deception or threats despite explicit opposition.• Whether there was a necessity for the recording.• The scope and manner in which the recording files were submitted or used.