According to a World Economic Forum (WEF) report, The Future of Financial Infrastructure, published in August 2016, distributed ledger technology (DLT) is one of many transformative new technologies that will shape future financial services infrastructure.

Six value drivers

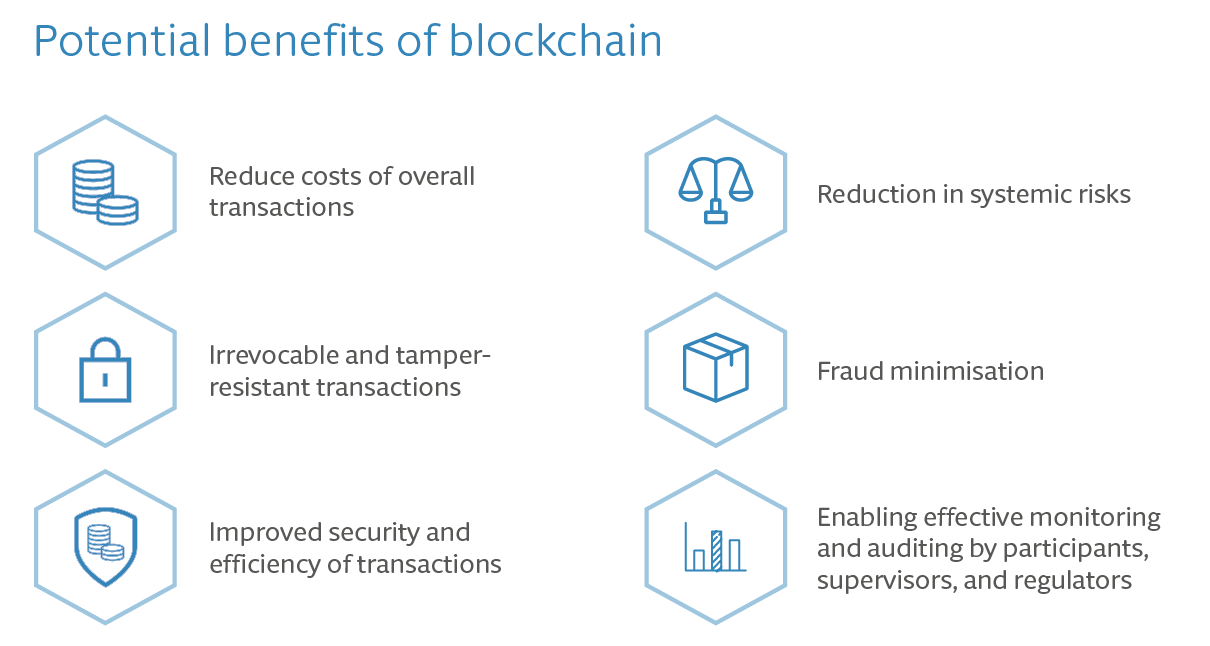

The WEF identifies six key value drivers of DLT:

- Operational simplification: DLT reduces manual efforts required to perform reconciliation and resolve disputes. The current practice of managing policy and claims data in separate ledgers can lead to inconsistent master and transaction data, resulting in erroneous, duplicated information, as well as a significant loss of time reconciling and correcting this data. This not only slows down the process but also forms a source of contract uncertainty. DLT is expected to bring significant efficiencies to this process.

- Regulatory efficiency improvement: DLT enables real-time monitoring by regulators of the financial activity of regulated entities.

- Counterparty risk reduction: DLT challenges the need to trust counterparties to fulfil obligations as agreements are codified and executed in a shared, immutable environment.

- Clearing and settlement time reduction: DLT disintermediates third parties that support transaction verification/validation and so accelerates settlement.

- Liquidity and capital improvement: DLT reduces locked-in capital and provides transparency into sourcing liquidity for assets.

- Fraud minimisation: DLT enables asset provenance and full transaction history to be established within a single source of truth.

These value drivers could:

- lead to a reduction in costs, errors and time;

- provide instant access and legal certainty;

- minimise reputational risks; and

- create an environment where there is no single point of failure.

Growing interest

Interest in DLT in the insurance sector has grown rapidly since 2015.

For example, in September 2015, the consortium R3 was launched and is now working with over 80 banks, financial institutions, regulators, trade associations, professional services firms and technology companies to develop Corda, a distributed ledger platform designed specifically for financial services.

The Lloyd’s insurance market in London has included DLT as part of their target operating model or TOM initiative, while AXA Strategic Ventures (along with other partners) invested around $55 million into a blockchain startup in February 2016.

In October 2016 Aegon, Allianz, Munich Re, Swiss Re and Zurich launched the blockchain insurance sector initiative B3i, aiming to explore the potential of DLT to better serve clients through faster, more convenient and secure services.

Firms are now developing proofs of concept using DLT to replace parts of the traditional insurance sector infrastructure.

Most recently, Allianz has announced its successful pilot of a smart contract solution to automate catastrophe swap transactions.

In April 2017, the UK’s Financial Conduct Authority stated in its ‘Discussion Paper on distributed ledger technology’ (DP17/3) that “in the second half of 2017 into 2018 we expect to see more movement from ‘Proof of Concept’ to ‘real-world’ deployments”.

It appears this prediction was correct, for on 15 June 2017 AIG announced it had sold the first blockchain-based multinational insurance policy to Standard Chartered.

The policy for Standard Chartered consists of a “master policy” in the UK, which is linked to local policies in the US, Kenya and Singapore.

How DLT could disrupt the insurance sector

- Potential for ultra-low transaction costs introduced globally.

- The ability to insure assets or risks that are not currently insurable.

- More efficient interactions between all the players leading to fewer errors and less legal uncertainty.

Receive free news and analysis – written by Hogan Lovells' world-leading legal teams and tailored to your preferences – by registering on Engage. You can also access our cutting-edge interactive Lawtech tools, designed to help you make better decisions and save time and money.