Failure by tenants to pay rent due under commercial leases is becoming a common occurrence in the Coronavirus (COVID-19) world. Unsurprisingly, rent collection difficulties are having far-reaching consequences on the property industry, particularly in relation to commercial property landlords and their financiers.

In response to the current economic climate, and in advance of the June quarter day, the UK Government recently announced new measures to protect commercial tenants, including an extension of the temporary ban on landlords forfeiting leases for non-payment of rent. The initial ban (set out under the Coronavirus Act 2020) was due to expire on 30 June 2020, but has now been extended until 30 September 2020.

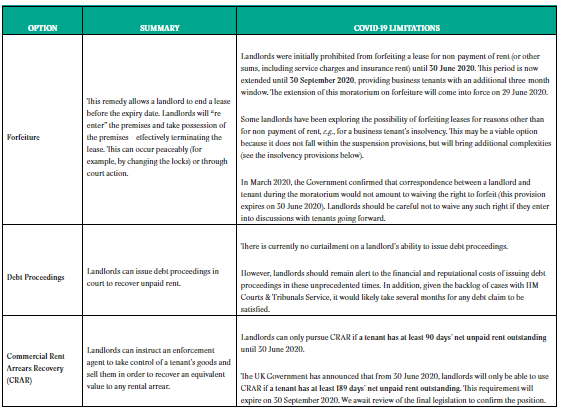

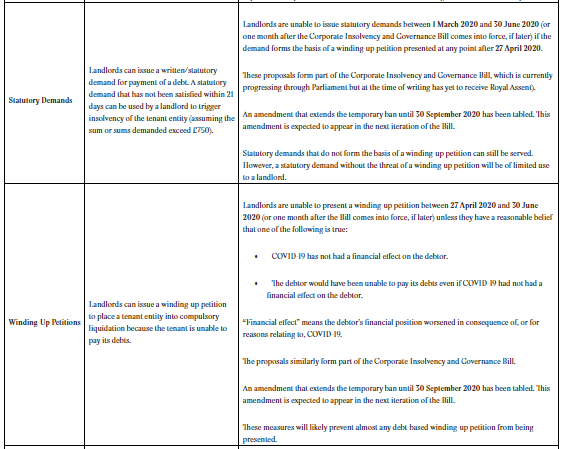

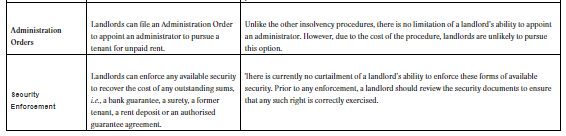

In light of the temporary curtailments of well-trodden remedies which were previously available to landlords faced with rental arrears, we have produced a user-friendly table below which summarises the current position on these options. The options referred to in the table are by no means exhaustive and should of course be considered in the context of the terms of the relevant lease. In these unprecedented times, we recommend that both landlords and tenants review their lease documentation to ensure that all options, remedies and reliefs are sufficiently explored.

The latest announcement in relation to the extension of protection measures for tenants follows the publication of a new voluntary Code of Practice for Landlords and Tenants. We have highlighted further key details on the Code below. Importantly, the Code confirms that tenants will remain liable for rent and service charge payments (subject to any contrary agreement being reached) – landlords and tenants need to be aware that, notwithstanding recent legislative changes, rent and other sums of money will continue to accrue during this “holding period”.

Whether you are a landlord, tenant or financier, please feel free to contact the McDermott real estate team for advice and guidance on your next steps.

New Code of Practice for Landlords and Tenants

On 19 June 2020, the UK Government published a new voluntary Code of Practice for Landlords and Tenants (“The Code”), encouraging landlords to engage in fair and transparent discussions with tenants over rental payments. The Code applies to all commercial tenancies, although it is expected to be of greater significance for landlords and tenants operating in the retail and hospitality/leisure sectors.New Code of Practice for Landlords and Tenants

The Code will apply until 24 June 2021. A copy of the Code can be accessed here.

Key points to note include the following:

1. Rent Arrears

The Code confirms that tenants will remain liable for rent arrears, subject to a contrary agreement being reached with their landlords. Tenants that struggle to pay rent when it falls due should seek to enter into a rent payment plan, seek rent deferrals, or ask a landlord to waive contractual default interest on unpaid sums. Where reasonable, landlords should provide such concessions while taking into account their own duties and financial commitments.

Notably, where tenants have received funds and savings from government support schemes, these should be used to pay rents as well as other financial liabilities.

2. Service Charges

Service and insurance charges should continue to be paid in full (subject to any contrary agreement with the landlord). However, where practicable, e.g., in cases where the lack of full use of the property means running costs are lower than forecasted, charges should be reduced where appropriate.

3. Impact on Banking Covenants and Financiers

Where a landlord’s commercial property is subject to a mortgage, a landlord will owe obligations to the bank. These obligations will typically extend to ensuring the protection of any rental income stream relating to the property. Importantly, the Code and the COVID-19-related legislation do not suspend any obligations owed by a landlord to its lender. However, as the financial sector is encouraged to assist businesses during the current crisis (with UK Finance stating its commitment to showing flexibility to commercial borrowers), it is generally considered that lenders may (or should) be more sympathetic in their dealings with borrowers in circumstances where the borrower is in breach of its financial covenants under their facility agreement due to legislative changes and/or COVID-19-related circumstances.

As a practical measure, it is recommended that landlords are proactive in terms of initiating a dialogue with their lender about any actual or likely future breach of their financial covenants. The decision will, of course, rest with the lender in terms of whether they are prepared to waive any breach but early communication is paramount to ensure productive discussions and preserve the relationship between the parties.

4. Status

The Code is voluntary and therefore places no legal obligation on landlords at this time. The Code does not undermine or alter the basis of the legal relationship or existing lease contracts, or override arrangements that have already been put in place. Nonetheless, the Code confirms the legal position that tenants are still required to pay their rent in full, with any variation in payment terms only becoming effective on agreement with their landlord.