In brief

Last week saw a number of key developments in relation to company tax rates, finally bringing to an end the significant uncertainty that has applied in respect of the Government's Ten Year Enterprise Tax Plan to progressively reduce the company tax rate down to 25 per cent.

Firstly, it was confirmed that the Government will no longer proceed with implementing the outstanding elements of its plan to have a 25 per cent tax rate apply to all companies. This means that only those companies which have aggregated turnover of up to AUD 50 million potentially will be eligible for a tax rate other than 30 per cent. Furthermore, the integrity rules which are to apply to those companies with effect from the 2017-18 income years were also passed by Parliament, along with the release by the Australian Taxation Office (ATO) of its guidance on these new rules.

In detail

Following much speculation, the legislation to extend the company tax cuts to larger companies (i.e. those with aggregated turnover greater than AUD 50 million) was defeated in the Senate.

Importantly, the former Prime Minister indicated last week that the Government "...will not be taking the tax cuts for larger companies to the next election". Instead, it will "...review our Enterprise Tax Plan insofar as it applies to small and medium businesses and focus on how we can provide enhanced support, or perhaps an acceleration of the tax cuts for the small and medium businesses".

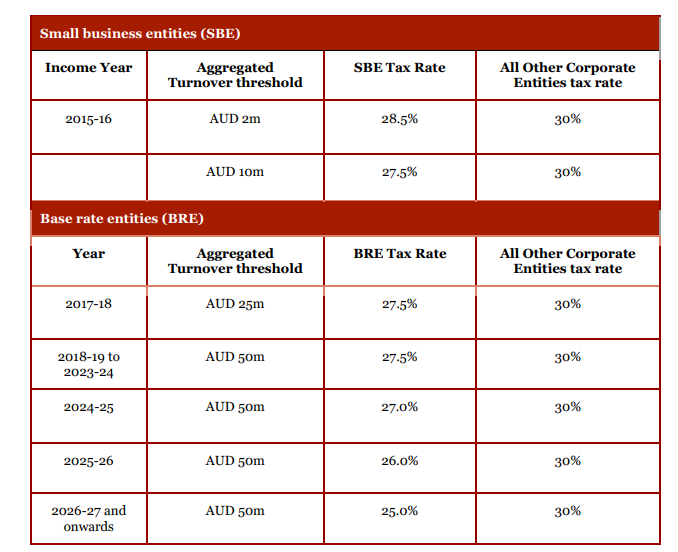

This means that under the current law, only those companies which have aggregated turnover of less than AUD50 million will have the ability to apply a reduced company tax rate of less than 30 per cent in the current and later income years. Table one below summarises the applicable turnover thresholds and corporate tax rates as currently enacted.

Table one

Base rate entities qualifying for reduced rate

We also saw the Treasury Laws Amendment (Enterprise Tax Plan Base Rate Entities) Bill 2018 complete its passage through Parliament last week. This measure operates to ensure that predominantly passive investment companies cannot access the lower company tax rates.

Specifically, with effect from the 2017-18 income year, a corporate tax entity will only qualify for the lower corporate tax rate if:

- no more than 80 per cent of its assessable income is `base rate entity passive income' (BREPI), and

- its annual aggregated turnover is less than the relevant threshold (AUD25 million for the 2017-18 income year; AUD50 million for the 2018-19 and later income years).

Under this new law, there is no longer a requirement that the company be `carrying on a business' to access the lower corporate tax rate for the 2017-18 and later income years. We are yet to see the ATO's final tax ruling on the `carrying on a business' requirement which remains relevant for the 2015-16 and 2016-17 income years when working out whether a company is a small business entity for tax rate purposes. Note also that for all relevant years, a company's aggregated turnover is based on ordinary income derived in the ordinary course of carrying on a business.

Base rate entity passive income will include, among other things, dividends (other than a non-portfolio dividends - defined broadly as dividends on shares with a voting interest in the company of at least 10 per cent), net capital gains, rent, interest, royalty, and certain amounts that flow through a partnership or a trust to the extent that it is attributable to an amount that is base rate entity passive income of the partnership or trust. There are no exceptions for a company that derives such income from the active carrying on of a business, other than in the case of interest derived by a financial institution or other authorised finance entity.

Coinciding with the passage of the legislation was the release by the ATO of Draft Law Companion Ruling, LCR 2018/D7 which provides guidance and examples to assist taxpayers apply the new tests, including:

- determining which amounts are `base rate entity passive income'

- the meaning of rent, interest, and when a share of trust or partnership income is referable to an amount of base rate entity passive income, and

- how to calculate the corporate tax rate for imputation purposes.

The Commissioner adopts a narrow interpretation of `rent' for the purposes of these rules, indicating that it will take its ordinary meaning as consideration payable by a tenant to a landlord for the exclusive possession and use of land or premises. Furthermore, it confirms that the `non-portfolio' dividend exclusion does not extend to dividend income that is distributed to a corporate beneficiary through a trust. Accordingly, all dividends received by a corporate beneficiary of a trust are considered BREPI. Comments can be made on the draft LCR until 5 October 2018.

Importantly, there is no choice to opt in or out of a lower company tax rate. Application of the lower rate is based entirely on meeting the relevant eligibility criteria, so companies will need to carefully assess and document their eligibility on an annual basis. This may mean that a company's actual tax rate may change from one year to the next. This is also made clear in the ATO's draft LCR.

Dealing with the past

For the 2015-16 and 2016-17 income years where it is a requirement to be a small business entity that a company be "carrying on a business", and due to the uncertainty around that concept, in Practical Compliance Guideline PCG 2018/D5 the Commissioner indicates that he will generally adopt a facilitative approach to compliance in relation to the application of the carrying on a business test. As such, the Commissioner will not allocate compliance resources specifically to conduct reviews of whether corporate tax entities have applied the correct rate of tax for those income years. However, this approach will not apply in all cases, including where a company has attracted ATO compliance activity for reasons unrelated to whether the correct corporate tax rate has been applied by the entity.

PCG 2018/D5 also explains the ATO's proposed administrative approach to incorrect franking for the 2016-17 and 2017-18 income years, allowing certain companies to inform their shareholders in writing of the correct franking credit attached to dividends paid in those years without reissuing the distribution statement.

The takeaway

It can be expected that the new Prime Minister is unlikely to re-instate the proposal to reduce the company tax rate for those companies with aggregated turnover of AUD50 million or more. However, it remains to be seen whether the Government will propose alternative incentives or provide enhanced support to small and medium businesses such as an acceleration of the already enacted tax cuts for those businesses.

A multi-rate corporate tax system seems to be here to stay, creating further tax complexity for affected companies and their shareholders alike. Accordingly, it is important for any company that is, or potentially will be, subject to the lower tax rates over the coming years to carefully consider the level of its aggregated turnover and the nature of its assessable income.