The Inflation Reduction Act ushers in the largest clean energy tax credit package in US history.

Key Points:

- Wind and solar tax credits receive a multi-year extension at full rates, and solar projects are eligible for the production tax credit.

- New tax credits are available for emerging technologies, including energy storage and clean hydrogen.

- Carbon capture tax credit rules are simplified and expanded.

- New manufacturing tax credits are available to support and grow the clean energy supply chain in the US.

- Most tax credits may be converted to cash payments from the Treasury Department under a new direct pay program or sold in the market under new tax credit transfer procedures.

On August 16, 2022, US President Joe Biden signed into law the Inflation Reduction Act (the Act), which offers long-term tax credit incentives for an expansive array of clean energy technologies. These incentives are a significant upgrade from the current energy tax credit programs, which were limited to specific technologies and have been the subject of ongoing phase-out and extension cycles over the past 20 years. Most clean energy technologies, including wind, solar, biomass, geothermal, and carbon capture, now have the certainty of a long-term and stable tax credit through at least the next decade. The Act also offers tax credit subsidies to a range of new energy transition technologies that did not previously benefit from tax credits. These technologies include energy storage projects, hydrogen projects that meet a minimum carbon emission to hydrogen production standard, existing nuclear power plants, biogas production facilities, and clean energy manufacturing plants.

Aside from extending current tax credit subsides and creating new ones, the Act introduces a number of new concepts to the clean energy tax rules. For most tax credits, the Act creates a new three-tier system for determining the credit amount, consisting of a lowered base credit, a "bonus" credit, and additional credits. The base and bonus credits are equal to the full value of the credits under prior law. To qualify for more than the base credit, a project must satisfy certain wage and apprenticeship requirements, unless certain narrow timing or project size exceptions apply. The Act provides bonus tax credits for projects built from components manufactured in the US as well as projects built in certain energy communities. The wage and apprenticeship requirements and the domestic content and energy community rules are described in further detail below.

The Act also creates a technology neutral tax credit that, starting in 2025, will be open to all technologies that satisfy minimum carbon emission standards. Most of the existing tax credits are designed to transition to the technology neutral tax credit program over time, which will be available at least through the end of 2032 and offer tax credit subsidies to low emission projects regardless of technology.

This Client Alert discusses in detail the clean energy tax credits that the Act modifies and introduces as well as the tax credit monetization options that it establishes. This Client Alert also offers takeaways on how the Act is likely to attract capital to the clean energy sector.

Modified and New Green Energy Tax Credits

Restoration and Extension of Production Tax Credit and Investment Tax Credit

The Act restores the production tax credit (PTC) and investment tax credit (ITC) to their full, unreduced amounts for renewable energy projects that are placed in service after 2021 and that begin construction at any time prior to 2025, assuming that the wage and apprenticeship requirements are met, or that qualify for an applicable exception. The PTC and the ITC are generally also eligible for bonus credits relating to domestic content or project location. When combined with the clean electricity tax credits described below, most renewable energy projects should qualify for the full value of PTCs or ITCs at least through the end of 2032.

The Act restores full PTCs for solar projects that begin construction before 2025. Prior to the Act, solar projects had been ineligible for PTCs since 2006. The PTC rate for projects placed in service in 2022 is 2.75 cents per kWh (assuming applicable labor requirements are met), adjusted by an inflation factor that the Internal Revenue Service (IRS) publishes annually. Under the Act, the Section 45 PTC for wind and solar phase out for projects that begin construction before 2025, and then transition to the technology neutral PTC described below.

The Act restores the full 30% ITC for solar projects that begin construction at any time prior to 2025, including solar projects that commenced construction before 2022, so long as they are first put into service after 2021. The extended 30% ITC also applies to a number of new technologies, such as energy storage (described in more detail below), biogas property (described below), and microgrid controllers. Under the Act, the ITC for projects that begin construction after 2024 is limited to the new permanent 2% ITC (10% if the labor requirements are met), though, as with the PTC, such projects will transition to the new technology neutral credit regime described in more detail below.

Expanded and Extended Carbon Capture Tax Credit

The Act extends the eligibility period for carbon capture projects to qualify for tax credits under Section 45Q for an additional seven years, increases the applicable credit rate, and substantially lowers the minimum capture thresholds for carbon capture projects to qualify for tax credits.

Carbon capture projects now have until 2033 to begin construction in order to qualify for tax credits. For this purpose, construction of the emissions source must begin before 2033 and either construction of the carbon capture equipment must begin before 2033, or the original planning and design of the emissions source must have included the installation of carbon capture equipment.

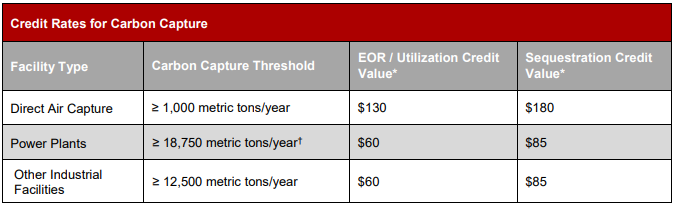

The Act imposes the wage and apprenticeship requirements on carbon capture tax credits, though the credit is a two-tier structure instead of a three-tier structure, as the domestic content bonus credits do not apply. The credit values for carbon capture projects that are placed in service after 2022 (assuming the labor standards are met or an exception otherwise applies) are significantly increased from prior law, and are indexed for inflation beginning in 2027. The Act also reduces the minimum carbon oxide capture thresholds that facilities must meet to qualify for the carbon capture credit, which vary by the type of carbon capture facility:

*If applicable labor standards are met

Certain capture design capacity requirements must also be met

The dramatic changes to the Section 45Q credit should provide the carbon capture industry with a muchneeded boost. The significant increase in tax credit value combined with reduced minimum carbon capture thresholds should open the market to a much wider range of projects and accelerate investment in carbon capture technologies. In general, the provisions of the Act relating to Section 45Q apply to projects or equipment placed in service after December 31, 2022.

New Energy Storage ITC

For the first time, the Act makes stand-alone energy storage projects eligible for a full 30% ITC. Prior to the Act, energy storage qualified for tax credits only if power used for charging was sourced from other tax credit qualifying generation sources, such as wind or solar power, and certain other requirements were met.

Under the Act, a storage project may qualify for the ITC if it receives, stores, and delivers energy for conversion to electricity or, in the case of hydrogen, merely stores energy, and if the project has a nameplate capacity of at least 5 kWh, or if it is thermal energy storage property. This definition is broad enough to encompass most of the conventional technologies used to store power, such as batteries, compressed air, and pumped storage. The ITC is not available for property that is primarily used for the transportation of goods or individuals and not for the production of electricity. Construction of an energy storage facility must begin before 2025 to qualify for the ITC.

To qualify for the ITC, stand-alone storage must be first placed in service after 2022 regardless of when construction first began on the storage system. The ITC is also available for the cost of post-2022 modifications made to an energy storage project that was first put into service before 2023 if the modifications sufficiently increase the name plate capacity of the energy storage system.

The ITC for stand-alone storage is subject to the same three-tier credit regime as other ITC eligible projects. A stand-alone storage facility automatically qualifies for the base credit of 20% of the full ITC, a bonus credit of 80% of the full ITC if it meets the wage and apprenticeship requirements and additional credits if it satisfies the domestic content and/or energy community requirements.

The new ITC for storage projects opens up possibilities for project owners to claim both a PTC on a wind or solar project and then claim an ITC on the storage components that are paired with the generation project.

New Interconnection Property ITC

The Act expands the ITC to include qualified interconnection property for an ITC-qualifying facility with a net output of not more than 5 MW. "Qualified interconnection property" is generally defined as property (other than microgrid controllers) that is part of an addition, modification, or upgrade to a transmission or distribution system that is required at or beyond the point at which the ITC-qualifying facility interconnects, and provides for the transmission or distribution of electricity produced by the ITC-qualifying facility. Qualified interconnection property must be constructed or paid for (subject to certain reductions) by taxpayers, or the original use of such property must commence with a regulated utility pursuant to an interconnection agreement.

New Biogas ITC

The Act further expands the ITC to include certain biogas facilities, which convert biomass -- generally organic material other than oil, gas, or coal -- to a gas that is at least 52% methane and is captured for sale or productive use (but not for combustion). Biogas facilities are subject to the three-tier credit structure and must begin construction before 2025 to qualify for ITCs.

New Advanced Manufacturing Credit

The Act creates a new advanced manufacturing production credit, intended to spur US manufacturing of certain components of clean energy projects, as well as for certain critical minerals important to the manufacture of those renewable energy components. The amount of the credit varies depending on the component or material being produced; for example, certain components are eligible for credit based on the component's weight or capacity, while others are eligible for credits based on the manufacturer's cost of production. The available credit for components produced and sold after 2022 is scheduled to be reduced beginning in 2030 and eliminated for components sold after 2032.

New Clean Hydrogen PTC and ITC

Clean hydrogen projects, including both "blue" hydrogen and "green" hydrogen, may qualify for either a PTC, based on the quantity of hydrogen produced or an ITC equal to a percentage of the cost to build or acquire the hydrogen project.

The production credit is determined based on the amount of clean hydrogen produced during the 10-year period following the date the production facility was placed in service, and both the PTC and ITC rates vary based on the facility's emissions rate per kilogram of hydrogen.

To qualify for either credit, hydrogen must be produced through a process that results in lifecycle CO2 equivalent emissions rate at the point of production of at most 4 kg of CO2 equivalents per kilogram of hydrogen. The hydrogen must also be produced in the US for sale or productive use in the ordinary course of a trade or business of the taxpayer, and the production and sale or use of the hydrogen must be verified by an unrelated party. Owners of hydrogen projects qualify for PTCs even if they use the hydrogen themselves rather than sell it to a third party.

Clean hydrogen credits cannot be claimed on a facility with equipment that is currently or has been used to claim carbon capture credits under Section 45Q. However, clean hydrogen projects that source power from renewable energy generation sources may claim PTCs on the renewable power projects even if the power is directly used by the same owner to produce clean hydrogen. The clean hydrogen PTC and ITC are phased out for projects that begin construction after 2032.

The ability of developers to claim tax credits on both the renewable energy projects that supply power to the hydrogen project and on the output of the hydrogen project itself should create a significant boost for green hydrogen projects.

An owner of a clean hydrogen facility may elect to claim the ITC instead of the clean hydrogen PTC. To qualify for the ITC, the clean hydrogen production facility must be first placed in service after 2022 regardless of when construction first began. For facilities that began construction before 2023, only the tax basis attributable to post-2022 construction qualifies for the ITC. The Act provides that subsequent Treasury Regulations will clarify that the clean hydrogen production facility ITC is subject to recapture if a facility's actual CO2 equivalent emissions are greater than its designed and projected emissions.

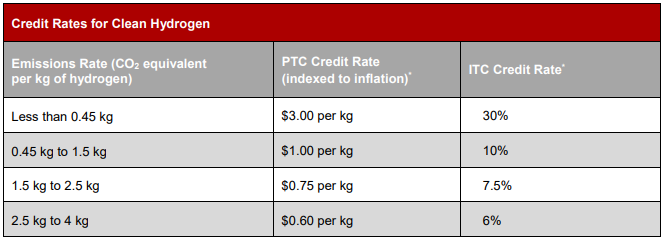

The credit rate for clean hydrogen is calculated based on the CO2 equivalents per kilogram of hydrogen that is produced or, in the case of the ITC, reasonably expected to be produced, as follows:

*If applicable labor standards are met

The PTC for hydrogen will generally be available for hydrogen produced after 2022, and the ITC will generally be available for facilities placed in service after 2022. The PTC for clean hydrogen is subject to the two-tier credit system -- 80% of the credit is lost if the wage and apprenticeship requirements are not met -- subject to a number of exceptions. However, the ITC for clean hydrogen is subject to the three-tier credit system, and bonus credits are available for projects that satisfy the domestic content requirements.

Clean Electricity Tax Credits

The Act creates a new clean electricity PTC under Section 45Y and a new clean electricity ITC under Section 48E for all power generation facilities that are placed in service after 2024, regardless of the technology used, if they generate no (or negative) CO2 equivalents and for any energy storage technology placed in service after 2024. These credits are equivalent to rates for the PTC and ITC discussed above, and are subject to the wage and apprenticeship requirements. The credits are also subject to a four-year step down and phase-out, scheduled to begin in 2032 at the earliest. The phase-out may begin later if, by 2032, the overall level of emissions from the production of electricity has not fallen to 25% or less of the 2022 rate of emissions.

Eligibility for the clean electricity credits will be determined by reference to an emissions table, to be published by the Treasury Department, listing categories of power production facilities and the CO2 equivalent emissions of each (including lifecycle emissions for fuel combustion and gasification facilities). Individual facilities likely can reduce their tabled CO2 emissions to account for anticipated emissions capture by that facility (unless such capture is used to generate carbon capture credits). For facilities that do not fit within a category on the emissions table, the taxpayer may petition the Treasury Department for an individual determination of the facility's emissions.

The clean energy ITC is subject to recapture if a facility's actual CO2 equivalent emissions are greater than 10 grams of CO2 equivalents per kWh.

New Nuclear Production Tax Credit

Existing nuclear power plants that are in service before the Act is signed into law are eligible for a new PTC. This "retroactive" credit is designed to protect the economic viability of the existing fleet of nuclear power plants in the US. The credit can be as large as $15 per MWh, and generally applies to nuclear power that is sold between January 1, 2024, and the end of 2032. Nuclear projects qualify for the full credit value only if they satisfy the wage and apprentice requirements for repairs and alterations made to the project during the tax credit period; otherwise the credit is reduced to $3 per MWh. The nuclear credit is reduced if the nuclear power project earns more than $25 per MWh (the "reduction threshold") from the sale of power and the receipt of certain other government subsidies from a zero emission credit program. Nuclear projects that earn more than the reduction threshold of $25 per MWh must reduce the credit value by 80% of the amount in excess of the reduction threshold. This means that the nuclear credit is reduced to $0 when a nuclear power project earns $43.75 or more per MWh. The credit is not available to certain nuclear projects that previously qualified for tax credits as advanced nuclear power facilities under Section 45J of the tax code (which generally applied to certain nuclear projects commissioned after August 2005).

New Clean Fuel Production Tax Credit

The Act creates a new clean fuel PTC that provides a per-gallon PTC of $1 for each gallon of low emissions fuel that is produced and sold. The credit rises to $1.75 for sustainable aviation fuels. The clean fuel PTC is subject to the two-tier system, meaning projects must comply with the wage and apprenticeship requirements or 80% of the credits are lost. Facilities producing clean fuel that claim the PTC may not claim clean hydrogen PTCs or carbon capture tax credits on the same facility.

New Tax Credit Architecture

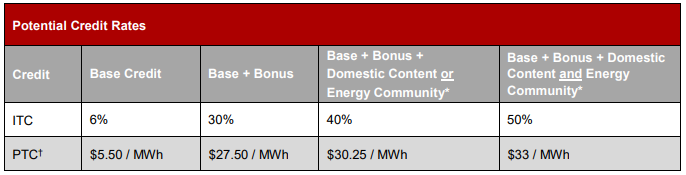

For most tax credits, the Act creates a new three-tier system for determining the credit amount, consisting of a lowered base credit, a "bonus" credit, and additional credits. The base tier, equal to 20% of the full credit, is available to all projects. The bonus tier, equal to 80% of the full tax credit value, is available to projects that meet certain labor requirements, including by paying market wages to employees and employing apprentices (described in further detail below). The new labor requirements apply to projects larger than 1 MW that begin construction 60 days or more after the Treasury Department puts out its guidance describing how these rules will operate. The base and bonus tiers combine to equal the historic full value of many credits, including the PTC and ITC.

Additional tax credits -- above the historic tax credit rate -- are available to projects that satisfy certain domestic content requirements and to projects that are sited in certain "energy communities," such as brownfield sites, areas where a coal mine or coal fire power plant was recently retired, and areas with recent high employment in the fossil fuel sector. Projects that meet either the domestic content requirements or the energy community requirements are entitled to an additional 10% above the full value of the PTC or up to 10 percentage points above the full value of the ITC for each program.

*If project is placed in service after 2022 PTC values are 2022 inflation-adjusted rates applicable to projects placed in service after 2021

An additional bonus credit (not reflected in the chart above) of up to 20% is available for certain small scale projects sited in low-income communities or on Indian land. The additional tax credits are generally available to projects placed in service after December 31, 2022. In one hypothetical circumstance, a small project in a low-income energy community claiming the ITC could receive a credit in an amount of up to 70%; a similar hypothetical project claiming PTCs could receive credits in an amount of up to $38.50 per MWh.

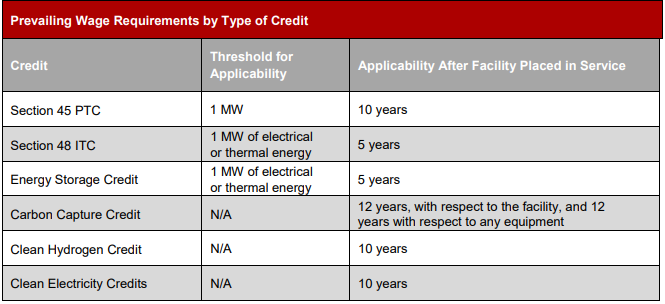

Wage and Apprenticeship Requirements

One of the Act's more significant changes is to tie the value of tax credits for clean energy projects to labor standards enacted by the US Department of Labor. Under these new rules, projects that do not satisfy the labor standards -- which consist wage and apprenticeship requirements -- are not eligible for the bonus tier of tax credits. The new labor standards have two important exceptions: they do not apply to projects with a capacity of less than 1MW and do not apply to any project that "began construction" earlier than 60 days after the Treasury Department issues guidance on both the prevailing wage and the apprenticeship requirements. While the Act does not define the term "beginning of construction" for this purpose, longstanding guidance from the IRS has historically interpreted this term liberally so that construction is deemed to have begun on a project if minimal construction work is completed either on or off the project site.

Prevailing Wage Requirement

The Act creates a prevailing wage requirement for full credit eligibility, which generally requires that any laborers or mechanics employed in the construction, alteration, or repair of the project are paid wages not less than the prevailing rates in the applicable locality, as determined by the Secretary of Labor. This requirement is applicable throughout construction, as well as to any work done during the applicable recapture or credit period (e.g., five years for ITC and 10 years for PTC). Project developers who fail to meet these requirements may bring their projects into compliance by paying the difference in wages, with 6% interest, to any laborer or mechanic paid less than the prevailing wage, and by paying a $5,000 fine to the Treasury Department for each underpaid laborer and mechanic for every year of underpayment, subject to additional penalties for intentional disregard of the requirement.

Apprenticeship Requirement

The Act requires that a certain percentage of all construction, alteration, and repair work on most tax credit generating property be performed by qualified apprentices for full credit eligibility. Any contractor or subcontractor that employs at least four individuals must also employ at least one apprentice and satisfy any applicable apprentice-to-journeyworker ratios published by the Department of Labor or applicable state apprenticeship agency. These requirements are generally subject to an exception for developers who fail to meet to meet these requirements despite attempting in good faith to satisfy them. Project developers who fail to meet these requirements may bring their projects into compliance by paying a $50 fine for each labor hour during which the requirement for a specified percentage of apprentice performed labor or the requirement for at least one apprentice were not met, subject to additional penalties for intentional disregard of the requirement. For projects that begin construction before 2023, the applicable percentage of total labor hours performed by qualified apprentices is 10%; 12.5% for projects that begin construction in 2023, and 15% for projects that begin construction after 2023.

Additional Credits for Domestic Content, Energy Communities, and Low-Income Communities

An additional credit is available for projects that use a minimum amount of domestic raw materials and for projects located in energy communities or low-income communities.

The amount of this bonus credit varies among the underlying credits: for PTCs (including the new clean electricity PTC), the domestic content bonus credit is 10% of the credit otherwise available (e.g., $100 of PTCs is increased to $110); for ITCs (including the new clean electricity ITC and the ITC for energy storage property), the domestic content bonus credit is generally 10 percentage points in addition to the credit otherwise available (e.g., a 30% credit is increased to 40%). As discussed below, projects that are eligible for the domestic content bonus generally must meet the domestic content rules in order to participate in the direct pay program.

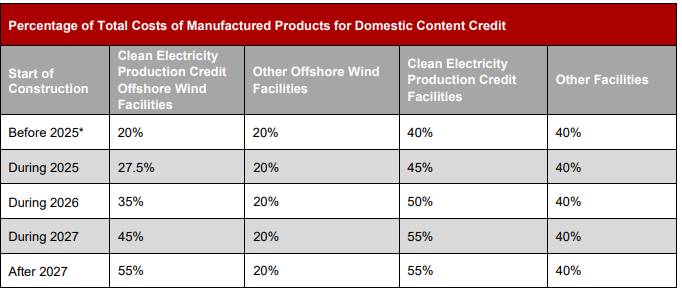

A project may qualify for the domestic content bonus if all of the steel, iron, and a minimum percentage of the manufactured products comprising the project were produced, mined, or manufactured in the US. The minimum domestic content percentage required for manufactured products increases over time and varies based on project type.

*If placed in service after 2022

Projects constructed in "energy communities" also qualify for a 10% increase to the applicable PTC (not counting any PTC increase as a result of domestic content compliance) or a 10 percentage point increase to the applicable ITC (reduced to two percentage points if the facility does not satisfy the prevailing wage requirements). An "energy community" is a brownfield site, an area which, at any time after 1999, had significant employment relating to the extraction, processing, transport, or storage of coal, oil, or natural gas; a census tract where a coal mine closed after 1999 or where a coal-fired power plant was retired after 2009; or any immediately adjacent census tract.

Certain small wind or solar projects -- those with a maximum output of less than 5MW (AC) -- may be eligible for additional credits if they are located in certain low-income communities. Eligible projects must be allocated an "environmental justice solar and wind capacity limitation." These tax credits will be accessed through a new annual credit allocation program that will be administered by the IRS. Unallocated credits can be allocated in subsequent years until at least 2032, or later if the overall level of emissions from the production of electricity has not fallen to 25% or less of the 2022 rate of emissions.

New Credit Monetization Options

Perhaps the most fundamental change for clean energy in the Act is the concept that tax credits may be converted into cash payments from the IRS (the direct pay program) or freely transferred among taxpayers in the open market (the tax credit transfer program). Both programs are designed to offer project owners two alternative ways to monetize tax credits outside of conventional tax equity financings.

Under current US federal tax law in effect prior to the Act, tax credits for most projects were available only to equity owners (or lessees) of a project. Tax credits that were not used to offset taxable income were not eligible for IRS refunds and were not transferrable to other taxpayers. These structural limitations inherent in the tax credit rules led to the development of the tax equity market as a way to allocate tax credits to the most optimal users, but involved complex financial arrangements that complicated the capital structure for most clean energy projects and development platforms.

The introduction of these two new alternatives has the potential to radically transform the capital structures used to develop and own clean energy projects in the US. It also opens the door for new forms of capital, such as municipal pension funds, to more easily access the clean energy sector and play a role in the clean energy transition.

The introduction of these alternatives is certainly a welcome development, but whether the direct pay and tax credit transfer programs will offer project owners the same value they were able to obtain using tax equity financings is not yet clear. As described in further detail below, the direct pay election is limited in scope. It is available only for projects owned by tax exempt entities or projects that claim tax credits for carbon capture, clean hydrogen, or clean energy manufacturing -- and is available only for a maximum of five years. The tax credit transfer program, while broader in scope, has a number of drawbacks compared to traditional tax equity. The transfer program is available only for tax credits and not for other project tax benefits, such as accelerated depreciation. Additionally, tax credit buyers using the transfer program are not permitted to deduct the payments made for tax credits (in contrast to tax equity investors, who are permitted a tax write-off of at least 50% on their tax equity investment), which may decrease the value of tax credits that are transferred rather than tax equity-financed.

Despite these shortcomings, both the direct pay and credit transfer programs represent meaningful progress towards a system that provides clean energy investors with more flexibility and optionality for realizing maximum value from their tax credit subsidies.

Direct Pay Program

The direct pay program is a more limited version of the "direct pay" option that was originally proposed last year as part of the Build Back Better Act. Direct pay allows project owners to apply for tax refunds in an amount equal to the value of their tax credits, although many of the procedural and timing rules remain subject to future regulations. As proposed, the direct pay program is not available to wind, solar, storage, or many other traditional renewable energy projects, unless those projects are owned by municipal coops, state or local governments, or certain other owners that are exempt from federal income tax.

The direct pay option is more widely available to owners of projects claiming 45Q credits, clean hydrogen PTCs, and clean energy manufacturers, but generally only for the first five years of the tax credit period, after which the tax credits are no longer eligible for the direct pay program.

The direct pay program is available to property that is put into service after 2022. Under this program, a project owner may make an irrevocable election for the year in which a project is placed into service and treat the credit amount as a payment of tax eligible for refund. The election is made on the tax return of the taxpayer that owns the project, which may be a partnership or other tax transparent entity.

The refundable credit amount under direct pay is determined by multiplying the tax credit available for any year by an applicable percentage. Any project with a maximum net output of less than 1 MW automatically qualifies for an applicable percentage of 100%, as does any larger project that begins construction before 2024. Beginning in 2024, projects that would otherwise claim the PTC, ITC, or clean electricity credits and wish to claim direct pay must comply with the phased-in domestic content requirements described previously, or face a reduction or total loss of direct pay credit for projects that begin construction after 2024. An exception may apply for projects for which using domestic content would increase the cost by more than 25%, or if required domestic materials are not sufficiently available.

Once a direct pay election is made for a particular project (or wind turbine), it is irrevocable and applies either to all credits generated by the project, or applies separately to each facility for which the direct pay election was made. For example, a PTC-eligible project must decide in its first year if it will elect direct pay on the full 10-year credit stream and claim direct payments on an annual basis or instead claim PTCs for the full 10-year period. However, a project containing equipment eligible for the carbon capture credit or hydrogen PTC must make the election for the year in which the equipment was placed in service (regardless of when the facility was placed in service), and such election will apply to each of the four subsequent taxable years before 2033.

Direct payments that are elected instead of an ITC are subject to the same recapture and tax basis adjustment rules as the ITC.

In the event that a taxpayer elects direct pay, it will not be permitted to also elect the tax credit transfer program. Additionally, taxpayers making the direct pay election that are deemed to receive an excessive payment with respect to the applicable credit will be subject to a penalty amount imposed by the Treasury Department.

Tax Credit Transfer Program

The tax credit transfer program enables certain non-tax-exempt project owners to sell their credits on the open market to a non-related taxpayer for cash. This "transfer" election generally is not available to projects that are eligible for the direct pay election, other than certain projects claiming hydrogen PTCs, carbon capture tax credits, or advanced manufacturing tax credits, each of which generally has the option to choose between direct pay or tax credit transfer, but not both. The transfer election applies to a wide range of tax credits, including the PTC, ITC, carbon capture credit, the advanced manufacturing credit, clean hydrogen credit, nuclear PTC, and clean electricity credits, in each case, for taxable years beginning after 2022. Payments received from the sale of a tax credit are not included in gross income, and the tax credit buyer equally cannot deduct the price paid for the tax credit.

In many ways, the transfer election mirrors the direct pay election, including with respect to the election procedure, the treatment of pass-through entities such as partnerships, the excessive payment penalty, and recapture and tax basis rules.

The tax credit transfer program seeks to create a significant parallel market for project owners to monetize their credits without entering into tax-equity arrangements. As in the direct pay program, project owners will forgo the value of accelerated depreciation deductions, and may receive cash in an amount less than the credit value in order to compensate the purchaser for the time value of money, and, in the case of ITC-based credits, recapture risk. The purchasers in this market will likely include well-seasoned tax-equity investors, but this program may also attract newer market participants, enticed by a structure that would permit them to obtain tax credits without bearing the economic risks of the associated project.

Conclusion

The Act promises to be the most transformative climate spending bill in recent memory. It dramatically expands the tax incentives available for energy transition projects and technologies and reduces many of the friction points that have slowed the development of clean energy in the US. These new rules will likely attract significantly increased capital to the clean energy sector and change the way clean energy projects are financed, tax credits are monetized, and capital organized and invested throughout the sector.