The EU is about to adopt new corporate sustainability due diligence rules which will likely affect many Swiss companies doing business with the EU.

In December 2023, the EU institutions reached a provisional agreement on the new Corporate Sustainability Due Diligence Directive (“CSDDD”). This Directive will introduce due diligence obligations for large EU and non-EU companies in respect of actual and potential adverse human rights and environmental impacts in their chains of activities (a new term of art explained below). The text is now at the final stage of the legislative procedure, awaiting formal approval by the EU institutions and publication in the Official Journal of the EU.

Other recent EU legislative initiatives related to corporate sustainability due diligence include the EU Corporate Sustainability Reporting Directive (CSRD), the EU Deforestation Regulation, the EU Conflict Minerals Regulation, the EU Batteries Regulation and the forthcoming EU Forced Labour Products Ban Regulation.

What companies will be directly subject to the CSDDD obligations?

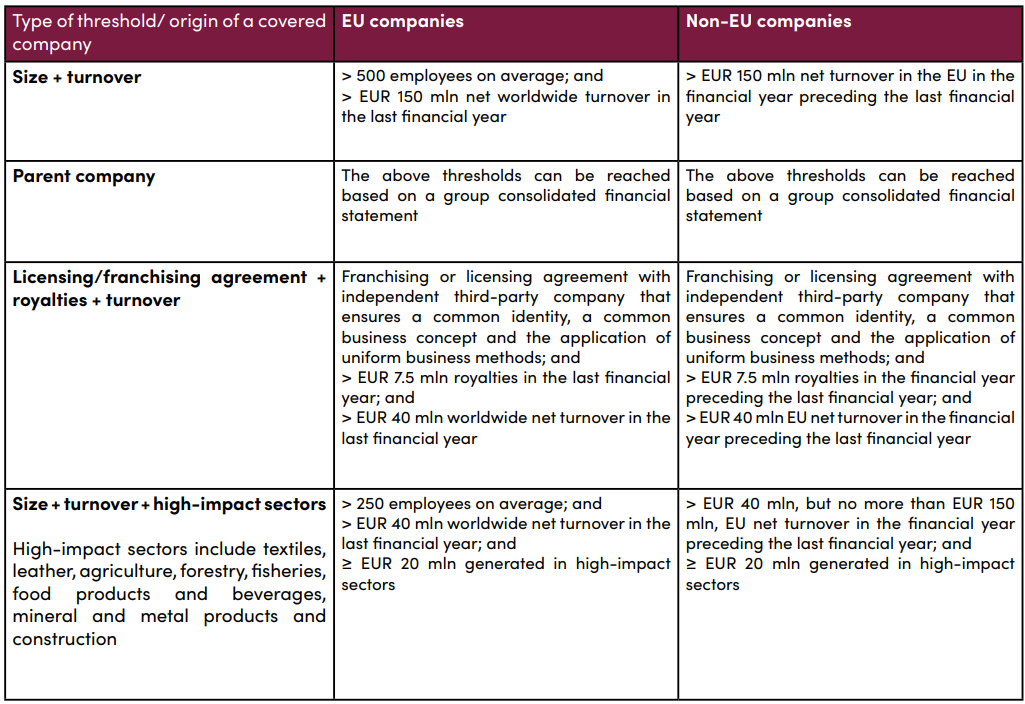

The CSDDD requirements will apply to both large EU and non-EU companies. However, different thresholds will apply to EU and non-EU companies:

What companies will be indirectly affected by the CSDDD obligations?

The due diligence obligations will apply not only to the activities of the in-scope companies but also to their direct and indirect business partners in the chain of activities. In-scope companies will need to ensure that their due diligence measures apply to their upstream business partners in the production of goods or provision of services (suppliers) and partially their downstream business partners (involved in activities including distribution, transport, storage and disposal of a product, excluding disposal by consumers and downstream activities that are subject to export control). As a result, in practice, many companies, irrespective of their size and turnover, involved in the chain of activities of in-scope companies will find themselves indirectly affected by the CSDDD obligations.

Will CSDDD apply to all sectors?

The CSDDD’s scope is broad. It will apply to companies in essentially all sectors, with some exceptions in the financial sector. In particular, the CSDDD will not apply to alternative investment funds (AIFs), undertakings for collective investment in transferable securities (UCITS), or to pension schemes operating social security systems under applicable EU law.

For regulated financial undertakings, such as credit institutions, investment firms and (re)insurance undertakings, only the upstream and not the downstream part of their chain of activities will be covered. A review clause enables additional sustainability due diligence obligations to be introduced for such undertakings in the future.

What are the key obligations?

In-scope companies will be required to comply with due diligence obligations with regard to the adverse impacts of their chain of activities on human rights and the environment. The “adverse impacts” under the CSDDD are those resulting from the violation of international human rights and environmental agreements as listed in Annex I to the CSDDD.

The scope of the due diligence obligations is based on the OECD Due Diligence Guidance for Responsible Business Conduct and will require in-scope companies, among other things, to:

• integrate due diligence into their corporate policies and risk management systems;

• identify and assess actual and potential adverse human rights and environmental impacts and regularly reassess their corporate operations and those of their subsidiaries and relevant business partners;

• prevent, stop, mitigate and remediate actual and potential adverse impacts;

• monitor their chains of activity and assess the effectiveness of the measures;

• engage meaningfully with stakeholders and report annually on the matters covered by the CSDDD;

• establish and maintain a notification mechanism and a complaints procedure for interested parties.

In addition, the CSDDD introduces an obligation for in-scope companies (other than those that only meet the relevant thresholds through turnover in high-impact sectors) to adopt and put into effect a transition plan for climate change mitigation to ensure the compatibility of the company’s business model and strategy with the transition to a sustainable economy and with the Paris Agreement objective to limit global warming to 1.5 °C.

What are the consequences in case of non-compliance?

Enforcement will be handled at EU Member State level. Each EU Member State will have to designate a supervisory authority which will have powers to impose penalties, including fines of up to, at least, 5% of the company’s worldwide turnover in the preceding financial year. In case of non-payment of fines, the name of the company and the nature of the infringement will be disclosed in a public statement.

In addition, EU Member States are required to ensure that companies can be held liable (civil liability) for damages arising from non-compliance with the CSDDD caused to natural and legal persons and that such persons have the right to full compensation. The limitation period for bringing an action for damages must be at least 5 years.

When will the CSDDD due diligence obligations apply?

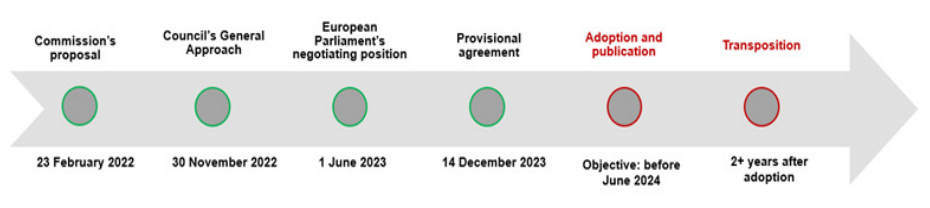

The EU institutions are aiming to finalise the CSDDD before the European elections in June 2024. Once formally adopted by both the European Parliament and the Council of the EU, the CSDDD will be published in the Official Journal of the EU and will enter into force on the twentieth day from its publication.

EU Member States will then have 2 years to transpose the requirements of the CSDDD into their domestic legislation. The largest in-scope EU and non-EU companies will have 3 years from the entry into force of the CSDDD to comply with its obligations. Smaller in-scope companies, depending on the category, will have 4 to 5 years to comply.

Impact on Swiss businesses

Given the close relationships between the Swiss and EU economies, a substantial number of Swiss companies is likely be affected – directly or indirectly – by the CSDDD. As mentioned above, the scope of the CSDDD is broad as its due diligence obligations apply in essentially all sectors. Additionally, although the due diligence obligations will only apply to large companies, they will indirectly affect all upstream and some downstream businesses of in-scope companies. In short, Swiss companies may be affected:

- directly: if they meet the thresholds envisaged for non-EU companies; and

- indirectly: if they form part of the chain of activities of in-scope EU or non-EU companies.

In Switzerland, businesses are already subject to some ESG due diligence and reporting obligations, but these are limited in terms of scope as compared to the CSDDD.

Businesses active in the field of minerals and metals from conflict-affected areas and child labour are required to comply with due diligence obligations set out in the Swiss Code of Obligations (Articles 964j-l) and in the Ordinance on Due Diligence and Transparency in relation to Minerals and Metals from Conflict-Affected Areas and Child Labour (DDTrO). These new rules entered into force on 1 January 2022. Obligations imposed on inscope companies include maintaining a management system, encompassing the supply chain policy, including due diligence, for relevant products and services, a traceability system and a grievances mechanism.

In addition, Switzerland imposes new transparency obligations for non-financial (ESG) matters for large companies of public interest (Articles 964a-c of the Swiss Code of Obligations). These obligations entered into force on 1 January 2022. The Ordinance on Climate Disclosures, in force since 1 January 2024, details the reporting obligations on non-financial matters specifically for climate-related matters. The Swiss non-financial reporting requirements will be aligned with the EU CSRD and a draft of the proposed amendments is expected in 2024.

Additionally, since 1 January 2023, large Swiss companies that have a branch in Germany are directly subject to the German Supply Chain Act. Swiss companies that are direct suppliers of in-scope companies are also indirectly affected, since they will be requested by their German customers to provide assurances of compliance with the Act. The German Supply Chain Act applies only to human rights adverse impacts.

Next steps

The CSDDD is currently awaiting formal approval by the Council. Considering that Germany and Italy are hesitant to support the current text of the CSDDD, Swiss companies should monitor potential changes to that text.

Once the CSDDD is formally adopted and enters into force, Swiss companies are well advised to map their supply chains to identify and assess the potential impact of the CSDDD on their business operations, with a view to ensuring timely compliance.

Companies should also closely monitor legislative changes in Switzerland, including the potential alignment of Swiss legislation with the new EU CSDDD.