As we approach the four year anniversary of Russia’s invasion of Ukraine, EU and UK sanctions against Russia continue to increase in complexity and continue to focus on the energy sector as a way to deprive Russia of revenue.

The latest EU measures focus on petroleum products (falling under CN code1 2710) which have been obtained in a third country (i.e. neither the EU nor Russia) from crude oil (falling under CN code 2709 00) which originated in Russia.

It has been said that the objective of the provision is to limit imports of Russian crude oil ‘through the back door’ into the EU, and the measure will have most impact on countries such as India which have historically purchased Russian crude oil, refined it and then supplied it to the EU.

Since 21 January 2026, it has been prohibited to purchase, import or transfer this third country refined product directly or indirectly into the Union. There are also ancillary prohibitions on technical assistance, brokering services, financing or financial assistance, as well as insurance and re-insurance.

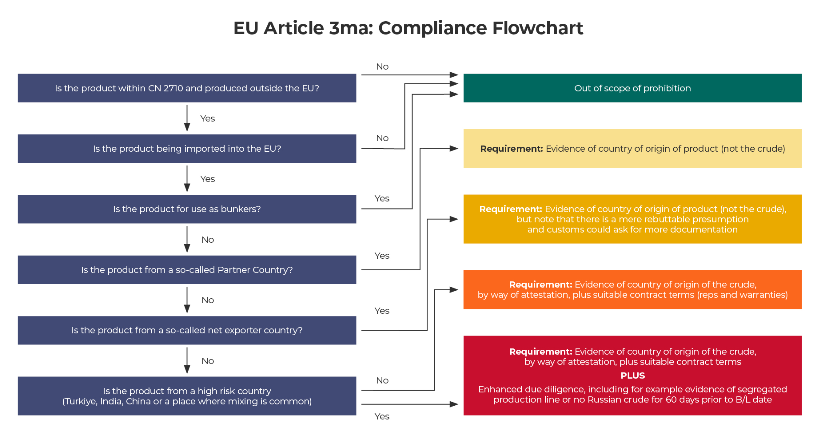

In order to comply with the prohibition, traders will need to identify the country of origin of the refined petroleum products, as different requirements will apply depending on the country of origin. These are summarised in the table below.

Decisions about whether to allow particular cargoes to be imported into the EU will be made by customs authorities in the relevant EU member state, and the customs authorities can require further evidence to demonstrate that the refined petroleum products are not derived from crude oil which originated in Russia.

As a result, traders should include terms in their contracts which not only require their counterparties to comply with sanctions but also require them to provide evidence of compliance. They can expect shipowners to include similar language in charterparties, to ensure that they are not prejudicing their insurance by carrying prohibited cargoes.

As with previous restrictions, these new sanctions play out in a complex geopolitical landscape and it is worth highlighting three additional issues:

- Firstly, we expect the UK to adopt equivalent measures but these have so far not been announced.

- Secondly, as with the transport of Russian crude oil, it seems almost inevitable that attempts will be made to circumvent and evade the restrictions. Traders should be vigilant to red flags which indicate that the origin of either the refined products or the crude oil from which they originate is mis-declared.

- Thirdly, the willingness of India to continue buying Russian oil does not only depend on whether doing so restricts access to European markets. On 2 February 2026, US President Donald Trump announced a trade deal with Indian Prime Minister Narendra Modi to reduce substantially US tariffs on the nation’s goods from 50% to 18%, seemingly in return for an agreement by Prime Minister Modi to stop buying Russian oil.

It will be interesting to see how quickly India stops buying Russian oil, how effective the EU restrictions are, and whether the UK introduces its own restrictions.

In the meantime, traders need to carry out due diligence on their supply chain, make sure their contracts are adequate, and be vigilant for signs of circumvention and/or evasion.